Budgeting often breaks down not because people lack information, but because feedback arrives too late to be useful. MoolaCon is designed around that idea, offering a budgeting experience that reacts to spending as it happens rather than summarizing it after the fact. The result is an app that feels less like a financial report and more like a guide for daily decision-making.

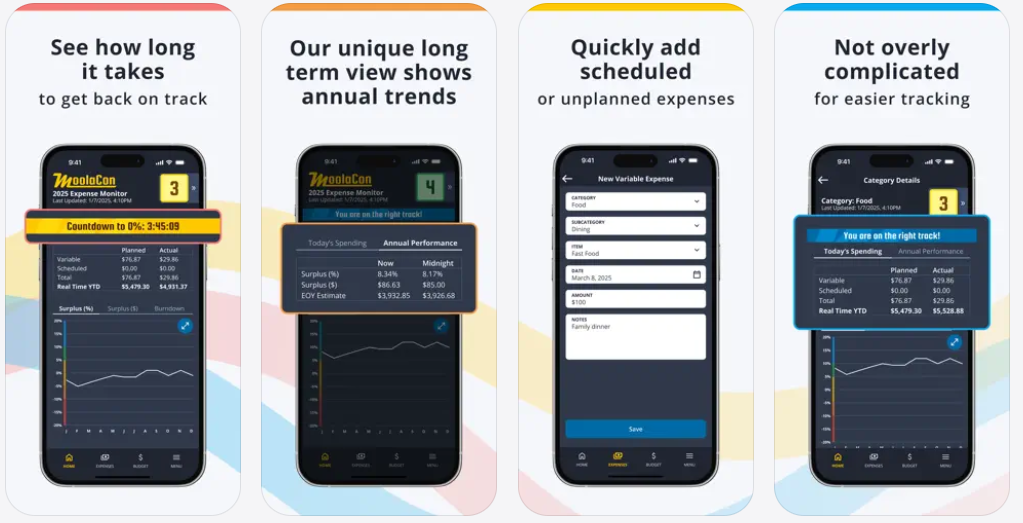

Instead of relying on traditional charts or category breakdowns, MoolaCon centers the experience on a single indicator called the MoolaCon Level. This five-tier “Spending Readiness Condition” reflects overall budget health and updates in real time as expenses are entered. With a simple scale from Level 5 to Level 1, the app makes it easy to understand whether spending is comfortably on track or starting to slip, without requiring interpretation or analysis.

What sets MoolaCon apart is how closely it ties feedback to time. Planned expenses and variable spending are continuously compared using minute-by-minute recalculations, giving users immediate visibility into how each purchase affects spending readiness. This approach keeps attention on the present moment, where spending decisions actually occur.

When spending trends move into deficit territory, MoolaCon introduces a countdown timer that shows the precise amount of time needed to return to a higher readiness level if variable spending stops. This feature reframes overspending in practical terms, translating budget pressure into a concrete timeline rather than an abstract warning. It encourages restraint without feeling punitive, offering clarity instead of alarm.

The app also looks beyond the current day. Surplus and deficit trend projections show how existing habits may influence outcomes later in the year, providing longer-term perspective without overwhelming the user. By focusing exclusively on expenses in its initial release, MoolaCon avoids unnecessary complexity and keeps the interface clean and focused.

MoolaCon does not attempt to replace comprehensive financial planning tools. Instead, it fills a specific gap for users who want to stay aware of their spending in real time and make adjustments before problems grow. The app’s emphasis on immediacy and simplicity makes it well-suited for people who want structure without constant monitoring.

For more information visit the website www.moolacon.com or download the app from the App Store.