Purse, Way2Wealth’s digital wealth management app, serves as a customised solution hub for each investor’s financial goals. Way2Wealth is a subsidiary of the Shriram Group, which is involved in commercial vehicle finance, life and general insurance, consumer and enterprise finance, financial product distribution, retail stock broking, chit fund, and wealth advisory business.

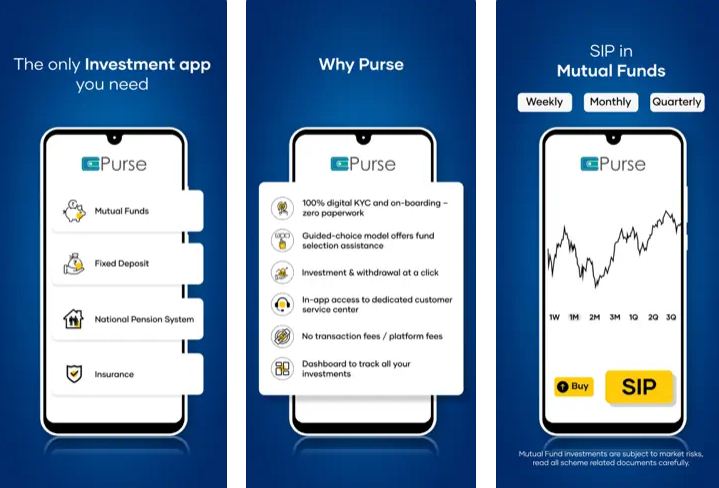

The Purse platform currently offers a variety of financial instruments such as mutual funds, fixed deposits (FDs), National Pension Scheme (NPS), and insurance products. They are actively working on integrating complementary products such as lending services, Broking, Portfolio Management Services (PMS), and a slew of other offerings to further diversify portfolios and accelerate financial growth trajectories as part of our ongoing commitment to improving our offering. The primary goal is to make investment a cost-effective, seamless endeavour free of complexities.

Purse’s meticulously curated portfolio selection assists in the discernment of the most suitable investment avenue, aligned with the overarching goal of nurturing long-term wealth, whether you are embarking on your first investment voyage or are a seasoned financial expert.

Here are some of the reasons why entrusting your investments to Purse is a wise decision:

- Streamlined Digital KYC and Onboarding: Say goodbye to time-consuming paperwork with our 100% digital KYC and onboarding process.

- Fund Agnosticism: We maintain a neutral stance towards funds in order to provide unbiased fund recommendations.

- Guided-Choice Model: Our guided-choice model streamlines the fund selection process by assisting experts in identifying the best options.

- Simple Investment & Withdrawal: You can initiate investments and withdrawals with a single click, putting you in control of your financial journey.

- Transparency in Fund Information: Important fund details are easily accessible, increasing transparency and facilitating informed decision-making.

- Diverse Payment Methods: We accept a variety of payment methods, allowing you to make investments that are tailored to your needs.

- In-App Dedicated Customer Service: Get direct access to our dedicated customer service centre from within the app.

- No Transaction or Platform Fees: Because there are no transaction or platform fees, your investment yield is maximised.

- Micro-SIPs Begin at Rs 100: Micro-SIPs allow you to enter the investment landscape with as little as Rs 100.

- Comprehensive Investment Tracking Dashboard: Use our comprehensive dashboard to easily monitor and manage your investments.

Final Thoughts

They ardently strive to deliver a superior customer experience that is rooted in dependability and trustworthiness, backed by a strong and secure infrastructure. Your financial endeavors are our top priority, and we will continue to provide an investment platform that truly empowers you.

0 Comments